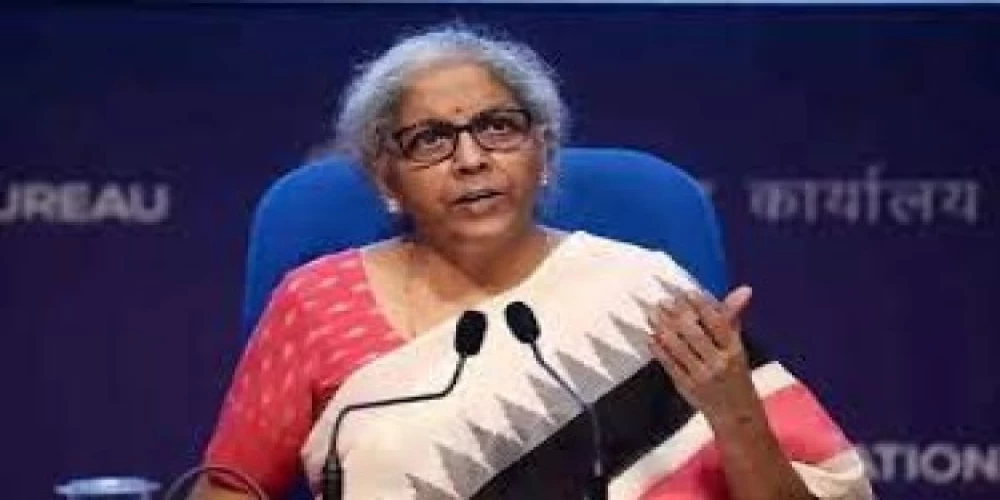

New Delhi: Finance Minister Nirmala Sitharaman on Thursday called on G20 countries to ensure that developing nations do not face any ‘unintended consequences’ of the proposed global minimum tax deal at the G20 and earn ‘meaningful revenues.’ She also said that the concerns of developing nations should also be addressed while formulating rules for the proposed two-pillar tax deal to ensure a fairer and inclusive tax system.

"...it is necessary to guard against any unintended consequences, which may have an adverse impact on developing countries. We shall continue to work for the strengthening of international cooperation for a fairer, transparent, efficient and effective global tax system that supports and empowers the developing countries in their efforts to mobilise resources," she said while addressing the 'G20 Ministerial Symposium on Tax and Development' in Bali.

A total of 130 countries, including India, had in July last year agreed to an overhaul of global tax norms to ensure that multinationals pay taxes wherever they operate and at a minimum 15 per cent rate. The finance ministry had then said that some significant issues, including share of profit allocation and scope of subject to tax rules, are yet to be addressed and a 'consensus agreement' would happen after working out the technical details of the proposal.

"There is a need to ensure that the developing countries are able to effectively participate in the negotiations as well. Resource constraints and the limited capacities to participate in the discussions at the inclusive framework need to be addressed to ensure that membership of the developing countries result in their needs and concerns being articulated and heard and that truly is the inclusive framework," she said.

Sitharaman called on the G20 inclusive framework to support the active participation of all members in the finalisation of the technical aspects of the two-pillar solution. This, she said, would ensure a "fairer, sustainable and inclusive tax system, which results in meaningful revenue" for the developing countries. "We need to have their (developing nations) inputs and include them particularly because these rules will affect them," the minister said. /BI/