New Delhi: Hindustan Petroleum Corporation Limited (HPCL) has announced the facilitation of UPI Peer-to-Merchant (P2M) payments via the HP Pay app in partnership with the National Payments Corporation of India (NPCI) and ICICI Bank. This initiative, the first in the Oil and Gas industry, enables customers to directly make payments via UPI through the HP Pay app.

UPI has become the common and preferred mode of payment for end users. With the launch of this service, users of the HP Pay app will now be able to make UPI payments to merchants outside the HPCL ecosystem as well.

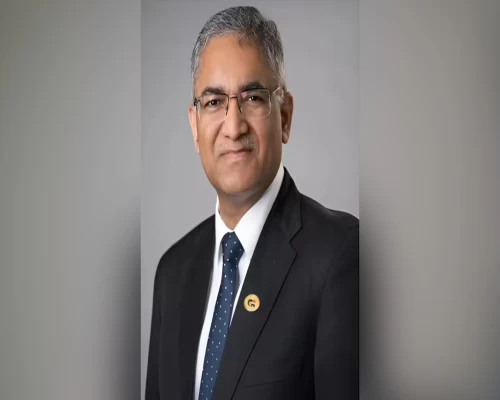

Speaking on the occasion, Shri Amit Garg, Director-Marketing at HPCL, said, "We are committed to providing innovative value propositions to our customers. We have collaborated with NPCI and ICICI Bank to enable P2M transactions in HP Pay through the Scan and Pay of any Bharat QR code, transforming fintech payments in the energy industry. This pioneering initiative for enhancing the digital experience simplifies payments by offering UPI as a direct payment option in HP Pay for fuel, LPG, lubricants, and non-fuel purchases, increasing convenience for our customers. This will enhance the value proposition of HP Pay, our flagship mobile app, which is seamlessly integrated with loyalty solutions and incentivizes customers using a host of our services."

Speaking on the partnership, Mr. Anuj Bhargava, Head – Global Clients Group at ICICI Bank, said, "ICICI Bank is pleased to partner with HPCL to embed the UPI Plugin into HPCL's 'HP Pay' app. The UPI Plugin is an integrated solution designed by ICICI Bank within the technology framework of NPCI, as per the guidance of RBI. The addition of UPI functionality eliminates the need for users to switch from a merchant app to a UPI-enabled app to complete payments. This further reduces the chance of transactions getting dropped, thereby increasing the success rate of transactions. We believe this partnership will enhance the overall user experience and strengthen digital payments."