New Delhi: A joint venture between ONGC and NTPC has signed an agreement to acquire renewable energy firm Ayana Renewable Power for an enterprise value of ₹19,500 crore ($2.3 billion). The deal marks a major step in India's renewable energy sector and aligns with the decarbonisation goals of both companies.

ONGC-NTPC Green Pvt Ltd (ONGPL), a 50:50 joint venture between ONGC Green Ltd (OGL) and NTPC Green Energy Ltd (NGEL), has acquired a 100 per cent equity stake in Ayana from its existing shareholders, National Investment and Infrastructure Fund (NIIF) (51 per cent), British International Investment Plc (BII) and its subsidiaries (32 per cent), and Eversource Capital (17 per cent). While the financial details of the cash transaction were not disclosed, ONGPL will also take over Ayana’s outstanding debt as part of the deal.

Ayana has a portfolio of 4.1 GW of operational and under-construction renewable assets spread across resource-rich states. Additionally, the company has 3 GW of projects in development, including solar, wind, and hybrid energy solutions, with a focus on round-the-clock renewable power. Several of these projects are expected to be commissioned between FY25 and FY27.

The deal is one of the largest in India’s renewable energy sector, second only to Adani Green Energy’s acquisition of SB Energy India for $3.5 billion in 2021. More recently, in December 2024, JSW Neo Energy agreed to acquire O2 Power Pooling for $1.47 billion.

ONGC has outlined a decarbonisation roadmap to achieve net-zero operational emissions by 2038. The company plans to invest around ₹2 lakh crore in renewable energy and green hydrogen projects, as well as reducing gas flaring to meet its emissions targets. This acquisition allows ONGC to expand its presence in the renewable energy space through an established platform.

"This acquisition marks ONGPL's first strategic investment since its inception in November 2024. The deal supports ONGC and NTPC's broader vision of achieving net-zero targets by 2038 and 2050, respectively. ONGPL will now leverage Ayana's platform for further expansion and growth," the companies said in a statement.

India has set a target of achieving 500 GW of renewable energy capacity by 2030 as part of its commitment to net-zero emissions by 2070. NIIF, which has played a key role in Ayana’s growth, has helped position it as one of India's leading renewable energy platforms, aligning with the country’s clean energy transition.

The transaction is subject to regulatory approvals and other closing conditions.

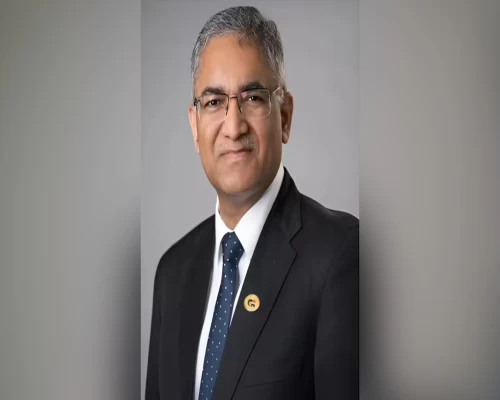

Sanjay Kumar Mazumder, CEO, ONGC Green Ltd, said, "The acquisition of Ayana is a strategic milestone in ONGC Green Ltd and NTPC Green Energy Ltd's pursuit of a clean energy revolution. As two of India's largest Maharatna PSUs, we recognise our responsibility in driving the nation's green energy ambitions. This acquisition propels us forward in accelerating India's transition to a low-carbon economy, leveraging our technical expertise, industry relationships, and financial strength."

Rajiv Gupta, CEO, NTPC Green Energy, said, "The acquisition... underscores our commitment to energy transition goals and leverages our advanced technical and industry experience along with financial strength. This also aligns with NGEL's mission of achieving the ambitious target of 60 GW by FY32 and moving forward to become one of the leading developers of utility-scale renewable energy projects in the country."

Vinod Giri, Managing Partner, Master Fund, NIIF, said, "Ayana's success reflects NIIF's dedication to scaling sustainable infrastructure investments. This transaction unlocks value while attracting global institutional capital into India's renewable sector. We look forward to seeing Ayana continue its growth trajectory with ONGPL."

Srini Nagarajan, Managing Director and Head of Asia, BII, added, "BII launched Ayana in 2018 to catalyse India's renewable energy sector. Having mobilised over $1 billion in capital alongside NIIF and Eversource, we are proud of Ayana's achievements and excited for its future under ONGPL's leadership."

Dhanpal Jhaveri, CEO, Eversource Capital, said, "Partnering with NIIF and BII, we have built Ayana into a leading renewable energy platform. As ONGPL takes the helm, we are confident that Ayana will further accelerate India's clean energy transition."

OGL, a subsidiary of ONGC, focuses on solar, wind, and energy storage solutions, pursuing both greenfield and brownfield acquisitions to accelerate India’s renewable transition. NGEL, a subsidiary of NTPC, leads NTPC’s renewable energy expansion and aims to achieve 60 GW of renewable capacity by 2032.

NIIF is India's sovereign-linked asset manager with $4.4 billion in equity capital commitments. BII is the UK’s development finance institution, supporting sustainable economic growth in emerging markets. Eversource Capital manages one of the largest climate funds in emerging markets, with a focus on energy transition, industrial decarbonisation, and urban sustainability.

BI Bureau