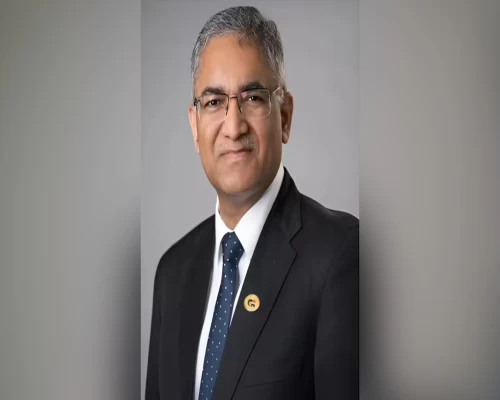

New Delhi: Power Finance Corporation (PFC), which was conferred with ‘Maharatna’ status as a central public sector enterprise (CPSE) on October 12 this year, has registered 32 per cent increase in standalone profit after tax (PAT) to Rs 2,759 crore in Q2 of the current financial year of 2021-22 as compared to Rs 2,085 crore in the last corresponding period.

The company has declared interim dividend of Rs 2 50 per share in Q2 of the current fiscal. Thus, so far PFC has given an interim dividend of Rs 4.75 per share, that is, 47.5 per cent, said company in a statement. Its capital to risk weighted asset ratio (CRAR) as on September 30, 2021 has been pegged at 21.76 per cent with Tier-I capital of 18.42 per cent and Tier-II capital of 3.34 per cent.

The net non performing assets (NPA) levels have dropped below two per cent. The net NPA ratio as on September 30, 2021 is 1.92 per cent, which is the lowest in the last five years. The company has registered 19 per cent increase in consolidated net worth at Rs 90,311 crore for H1’22 as compared to Rs 75,596 crore for H1’21.

According to the statement, PFC has clocked 22 per cent increase in consolidated PAT at Rs 9,578 crore for H1 ’22 as against Rs 7,847 crore in H1 ’21. It has logged 18 per cent increase in net interest income at Rs 15,069 crore for H1’22 as compared to Rs 12,782 crore in H1’21.

The reduction in consolidated net NPA ratio from 2.60 per cent in H1’21 to 1.72 per cent in H1’22 has been attributed to resolution of stressed assets. “Our inherent strength and strong fundamentals has led to consistent performance quarter on quarter,” said PFC in the statement. /BI/