New Delhi: REC Limited has undertaken an exclusive listing of its recently issued Green bonds of USD 750 million raised under its Global Medium Term Programme of $ 7 billion at GIFT IFSC Stock Exchanges in a primary listing ceremony held in GIFT IFSC, Gandhinagar, on Wednesday.

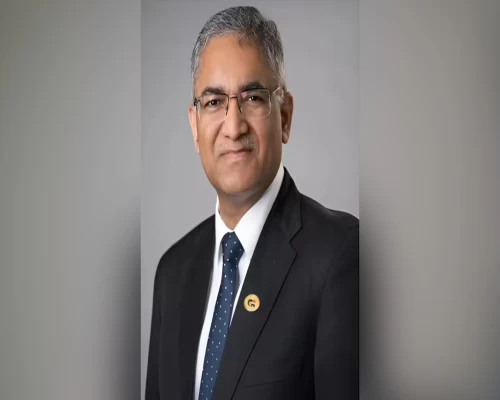

Injeti Srinivas, Chairman, International Financial Services Centres Authority (IFSCA) was the Chief Guest at the listing ceremony, which was attended by Vivek Kumar Dewangan, Chairman and Managing Director (CMD), REC and Ajoy Choudhury, Director (Finance), REC and other senior officials of India INX and NSE IFSC.

Commenting on the occasion, Vivek Kumar Dewangan, CMD, REC Limited, said: “We have consciously decided on the exclusive listing of REC’s recently issued Green Bonds on IFSC Stock exchanges, which have come a long way in their acceptability amongst the global investors.”

“This Green Bond issuance reinforces REC’s status as one of the most accomplished and frequent issuers in the international capital markets and is poised to contribute in India meeting its Amrit Kaal commitments towards climate action plan and energy transition with focus on green projects.”

This is the largest ever senior USD tranche by an Indian NBFC (largest ever senior Green Bond Tranche by a South and South-East Asian issuer) and first Green Bond issuance by an Indian Company post India’s G20 Presidency.

Injeti Srinivas, Chairperson, IFSCA, said: “We are pleased that REC Limited, a Maharatna Company, has listed their USD 750 million green bonds exclusively on the IFSC Exchanges. With this listing, the cumulative ESG labelled bonds listed on IFSC Exchanges has crossed USD 10 billion.”

“GIFT IFSC is emerging as a gateway to facilitate raising of foreign capital into sustainable projects in India, thereby contributing towards achieving our climate change commitments and SDG goals.”

V Balasubramaniam, MD and CEO, NSE International Exchange, said: “We are extremely delighted that REC has done an exclusive listing of their green bonds of $ 750 million in NSE International Exchange and India INX at GIFT IFSC, taking their total listing to USD 4.75 billion under $ 7 billion Global Medium – Term Note Programme.”

Arunkumar Ganesan, Chief Business Operations and Listing, INDIA INX, said: “We take immense pleasure in welcoming green bonds of US $ 750 million issued by REC Limited on India INX as they have reposed trust in India’s own IFSC and chose to list here exclusively, they will enjoy the lower withholding tax benefit of 4 per cent.” /BI/