New Delhi: Google has introduced its digital wallet application, Google Wallet, in India. This application offers users a secure platform to store private information such as loyalty cards, transit passes, and IDs. Despite this launch, Google assures users that its existing UPI application, Google Pay, will remain unaffected.

Google Wallet provides quick access to payment cards, passes, tickets, and IDs. However, its India version will not support credit and debit cards, unlike its global counterpart. In contrast, Google Pay serves as a comprehensive financial management tool, enabling users to send money, earn rewards, and track spending habits.

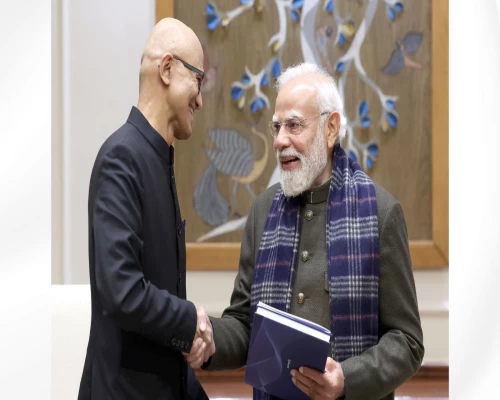

Ram Papatla, GM & India Engineering Lead, Android at Google, emphasized that Google Pay remains the primary payments app, while Google Wallet is tailored for non-payment use cases.

To access Google Wallet in India, Pixel smartphone users will find it pre-installed, while others can download it from the Play Store. However, the app will not be available on wearables. Google has partnered with several prominent brands for its launch, including PVR INOX, Flipkart, and Air India. /BI