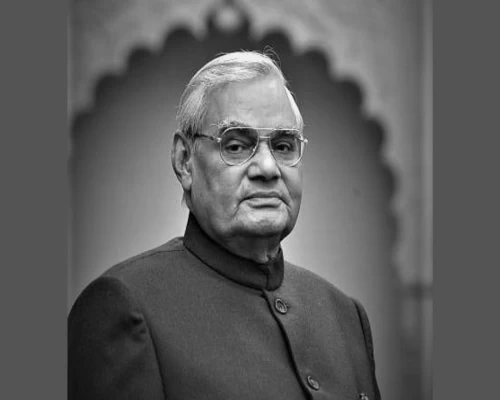

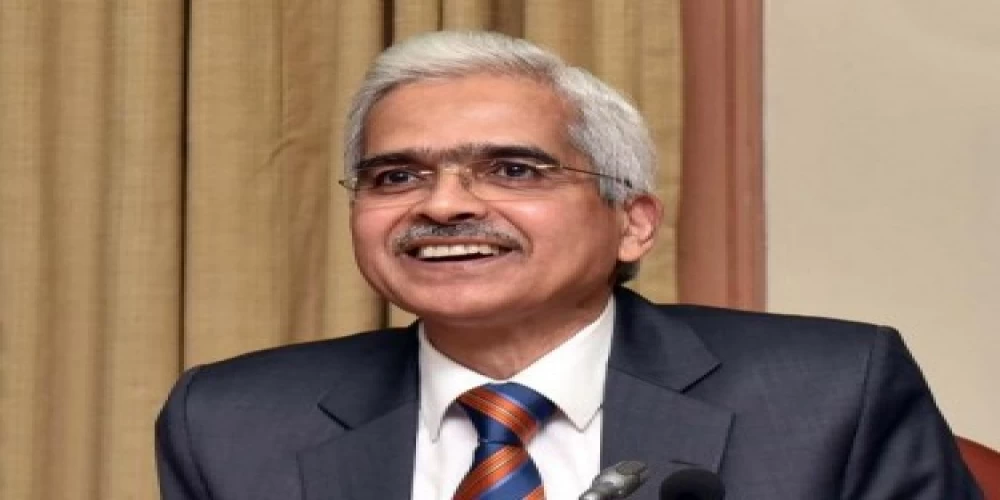

New Delhi| Reserve Bank of India (RBI) Governor Shaktikanta Das, while emphasizing that India has tremendous potential and will certainly bounce back, on Wednesday said: “We all need to act together and act in time.”

Das, who was addressing FICCI’s National Executive Committee Meeting (NECM) here, Das said: “The enabling policy environment would evolve around the initiatives taken by India’s businesses to seize these opportunities and actualize the potential of the Indian economy as a rising economic power of the 21st century.”

He also outlined key areas which can help India to propel. “India has tremendous scope to capitalize on the new opportunities. The five areas that will determine our ability to sustain India’s growth in the medium-term include Human Capital in education and health, Productivity, Exports, Tourism and Food processing,” he added.

Das said that by all indications, the recovery is likely to be gradual as efforts towards the reopening of the economy are confronted with rising infections. He further urged the industry to play an active role by investing more in the R&D. “Government, private sector must work together to enter the global value chain,” he emphasized

The RBI Governor said that India needs to move up on global agriculture value chain. Despite being one of the largest food producers, India’s position in the global value chain is quite low. He further added that food processing is a sunrise industry for India.

Das said that the tourism and hospitality sector has been impacted more by COVID but also expressed hope for early revival. “Tourism as an engine of growth and pent up demand could drive a V-shaped recovery. Employment elasticity for the tourism sector is also quite high,” added Das.

He further said that among the sunrise sectors that offer potential for higher exports in the post-COVID period are drugs and pharmaceuticals. “A sharp policy focus on other global value chain intensive network products, including equipment for IT hardware, electrical appliances, electronics, telecommunications, and automobiles would also provide the cutting edge to India’s export strategy with considerable scope for higher value additions,” said Das.

The Governor said that the immediate policy response to COVID in India has been to prioritize stabilization of the economy and support a quick recovery. He also stated that with a view to further promoting innovations in financial services, RBI has announced an Innovation Hub. “This will focus on new capabilities in financial products and services that can help in deepening financial inclusion and efficient banking services,” he noted.

Dr Sangita Reddy, President, FICCI said that reviving the economy requires coordinated efforts from all stakeholders including the government, regulators and the industry. “The RBI stands battle-ready to fight the economic downturn and industry appreciates this and stands alongside in this joint battle,” she added.

Dr Reddy further said that although the unlocking phases of economy have helped restarting of businesses, the damage caused by COVID-19 is colossal and will require a much longer time before improvement is seen on a sustained basis. “A lot more support is needed to rebuild, restart, revive and sustain businesses, especially in the hard-hit sectors like tourism, aviation, hospitality, retail and healthcare,” she emphasized.

Dr Reddy added, “We would like to thank the RBI for announcing the much needed one-time restructuring scheme. We would like a review of the eligibility criteria and timelines laid out under the scheme as we feel that several deserving accounts may not qualify and miss out on this window of opportunity.”

Uday Shankar, Senior Vice President, FICCI said that during the pandemic time, the role of the RBI is to stabilize the entire financial sector and ensure that the revival is faster. FICCI Past Presidents Sandip Somany, Y K Modi, Dr Jyotsna Suri, Harsh Pati Singhania, Sudhir Jalan, Rashesh Shah, Habil Khorakiwala along with other FICCI National Executive Committee members also interacted and shared their perspective with the RBI Governor.